Recent years have observed both FTA and Pay-TV channels’ market undergoing some noticeable transformations. Certain TV channels have ceased their broadcasting or opted out of the official electronic audience measurement, while a number of new, especially thematic ones, have entered the market. At present, there are a total of 58 measured TV channels that do sell their advertising space in the official television currency – GRP.

Out of the total count of 58 TV channels, 36 are free-to-air. It means that viewers can watch these channels not only through Pay-TV operators’ service but also for free via the digital terrestrial broadcasting. “Back in 2018, there were 37 of these FTA channels – just one more than we have now. So, at first glance, it may seem that the free-to-air channels’ market isn’t really growing, but the opposite is true,” asserts Michaela Suráková, Managing Director at Atmedia – a company which commercially represents nearly 30 thematic television channels on the Czech market. She further elaborates that while some TV channels discontinued their broadcasting or pulled out of the official audience measurement in the past couple of years, in connection with the digitalisation and the transition to DVB-T2, digital terrestrial multiplexes have started filling the gap with Nova and Prima commercial TV groups’ channels. Since 2018, they’ve launched channels such as Prima Star, Prima Show, CNN Prima News, and Nova Lady.

“AMC, a media company that previously exclusively offered Pay-TV channels, has now also made its debut on the free-to-air market,” highlights Michaela Suráková. She adds that the lifestyle TV – Spektrum Home – formerly available solely through Pay-TV operators, have commenced broadcasting in one of the digital terrestrial multiplexes in February this year. “Terrestrial broadcasting holds a long-standing tradition in the Czech Republic, with a substantial number of viewers still relying on this type of TV reception. With free-to-air channels getting a bigger piece of the audience share, they can boost their advertising revenues,” explains Michaela Suráková.

Pay-TV: New Players, More Channels

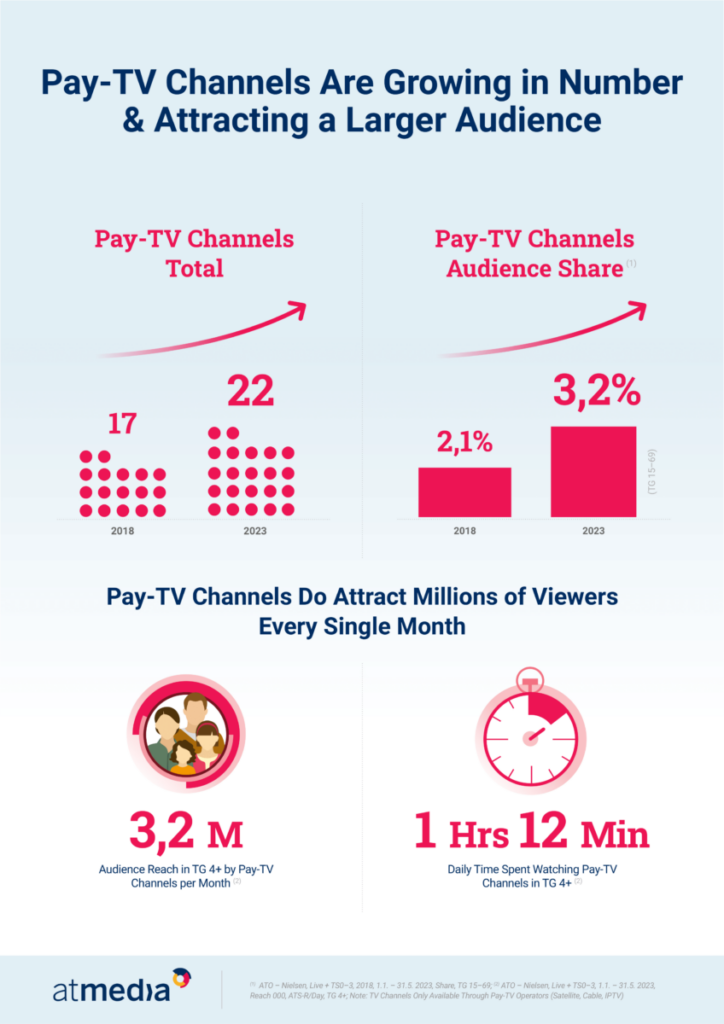

While the number of measured free-to-air television channels remains relatively unchanged compared to six years ago, the Pay-TV channels’ market has undergone some more pronounced changes. “New players, more channels – that’s a brief summary of the Pay-TV market development in recent years,” remarks Michaela Suráková. While there were 17 Pay-TV channels included in the official electronic audience measurement in 2018, as of May this year, the number has increased to 22. Playing a significant role in this growth is the AMC’s inclusion of two Pay-TV thematic channels, which, since 2018, added AMC (movie) and TV Paprika (lifestyle) into its portfolio of measured television channels.

Moreover, the recent years’ Czech Pay-TV market has witnessed the entry of new players – specifically Warner Bros. Discovery and CANAL+ media groups. Since 2018, the former one introduced three Pay-TV thematic channels into the official audience measurement – Discovery Channel (documentary), Eurosport 1 (sports), and TLC (lifestyle). On the other hand, the CANAL+ group announced its presence on the Czech market by launching their movie and series channel – CANAL+ Action. Additionally, through the acquisition of SPI International, it also gained ownership of the FilmBox movie channel, together with its sister channel FilmBox Stars.

Local Content Is Thriving

“The Czech Pay-TV channels’ market evolves alongside the increasing number of households that do subscribe to Pay-TV operators’ services, thereby gaining the access to dozens of Pay-TV channels,” explains Michaela Suráková. She further points out that there is a growing interest in Pay-TV channels among the viewers. Over the past six years, their audience share in target audience aged 15–69 has increased by 54%. On average, each month they reach a combined audience of 3.2 million viewers aged 4 and older, with an average daily viewing time of 1 hours and 12 minutes.[1]

“The growing interest in Pay-TV channels can also be attributed to their ability to cater to viewers’ preferences,” states Michaela Suráková, citing examples such as a greater amount of local content or a selection of exclusive movies and series that can’t be found elsewhere. “By including a larger number of Czech titles into its programme offer, FilmBox has substantially increased its audience share and is now the leading Pay-TV channel in our country,” highlights Michaela Suráková using a specific example.

[1] ATO – Nielsen, Live + TS0–3, 2018, 1. 1. – 31. 5. 2023, Share, TG 15–69, Reach 000, ATS-R/day, TG 4+, TV Channels Only Available Through Pay-TV Operators (Satellite, Cable, IPTV)